Toronto taxpayers could see a 6.9 per cent property tax hike as part of the city’s newly announced 2025 budget.

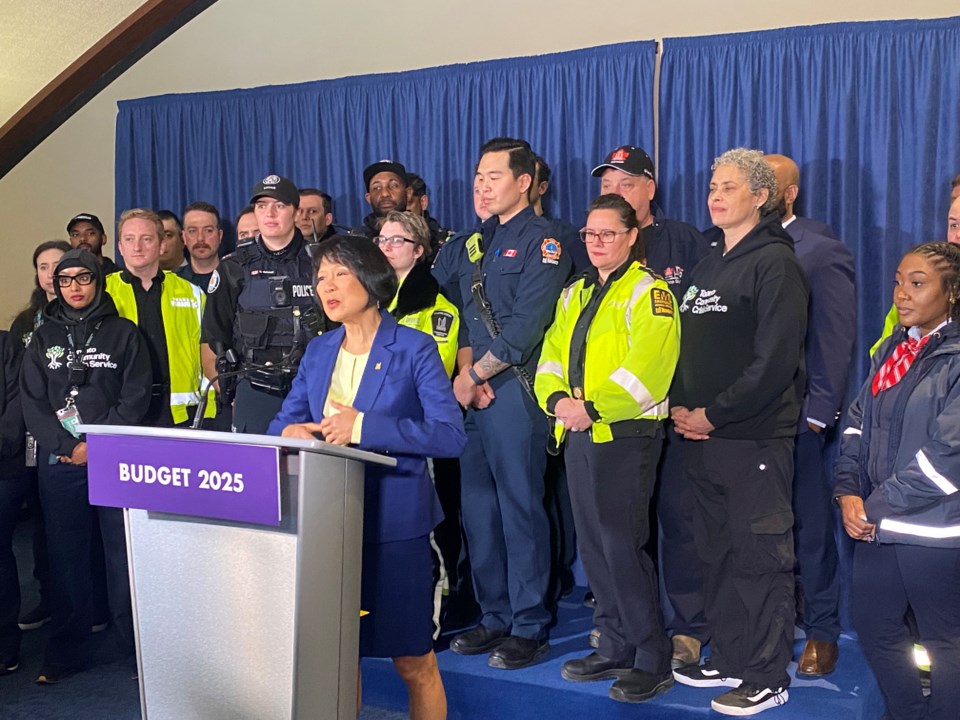

On Monday, Mayor Olivia Chow and budget chief Coun. Shelley Carroll unveiled this year's proposed city budget. The financial plan must still undergo two weeks of council hearings before the mayor presents her final version on Feb. 1.

“This proposed budget will mean change in Torontonians’ lives today,” Chow said at a Monday morning press conference.

She defended the tax increase as necessary to fund critical city functions including TTC services, hiring more police officers and traffic agents, and a switch to longer library hours.

Coun. Carroll said the city needs more money because “Toronto is still recovering from over a decade of underinvestment, which left us vulnerable to face the challenges we face today.”

The 6.9 per cent tax hike — slightly lower than former mayor John Tory’s 2023 rate increase — is split into two parts. It consists of a 5.4 per cent property tax increase and a 1.5 per cent raise to the city building levy, which directly funds capital projects like transit and housing.

Overall, the increase means Torontonians will pay $268.37 more than they did in 2024 — or roughly $23 per month — for the average residential property.

Where does the money go?

The tax hike will earn the city over $320 million in new revenue to help fund its $18.8-billion operating budget, which is $1.8 billion higher than the $17-billion 2024 operating budget.

However, just $654 million is coming in the form of new city spending.

The other $1.2 billion is money from federal or provincial government programs delivered by the city — like the federal government’s $10-per-day child care plan — and internal transfers between city departments.

Of the new $654 million, nearly $100 million will go to increasing TTC service, hiring 276 new police officers, paramedics and firefighters, instituting a new school lunch program, and expanding public library and outdoor pool hours.

The city has also earmarked around $300 million for new contracts with several unions. Officials declined to give an exact number as negotiations are still underway.

Chow’s 2024 budget brought in a 9.5 per cent property tax increase — an annual average of $338 per household — the largest raise in post-amalgamation Toronto history.

Last year, staff proposed a 10.5 per cent property tax increase but Chow angled to bring it down to 9.5 per cent.

If city hall follows that political playbook again, 2025’s final property tax hike could come in lower than the 6.9 per cent figure unveiled on Monday.

With Monday’s 6.9 per cent increase and 2024’s 9.5 per cent hike, Toronto’s property tax burden is still below most other large GTA municipalities like Brampton, Markham and Hamilton.

Trying to find savings

Coun. Brad Bradford, a vocal Chow opponent, criticized the 2025 budget for adding costs when life is getting more expensive.

“The mayor is introducing a budget that is triple the rate of inflation,” Bradford said. “The sentiment in the city right now is you’re paying more and you’re getting less.”

Canada’s monthly inflation rate decreased from a high of 2.9 per cent at the beginning of 2024 to 1.9 per cent in November 2024.

City manager Paul Johnson said keeping the tax hike in line with inflation “would have a significant impact” on services.

“It’s something that’s pretty unrealistic for the city to look at at this point, given the budget pressures and what needs to be done,” Johnson said.

Monday’s budget includes $680 million in savings and offsets, largely realized through spreading particular projects out over a longer period of time, Carroll said.

The city cut $41 million from its spending plan through “true efficiencies,” said Stephen Conforti, Toronto’s chief financial officer. He pointed to renegotiated hotel shelter contracts, which saved the city $30 million. Other savings include lower debt servicing costs because Toronto’s credit rating was upgraded to AA+ for the first time in decades.

Tenants and small businesses shielded from rate increase

Chow said the budget was crafted to prevent landlords from using the tax increase to justify raising rents beyond the 2.5 per cent permitted by the province on rent-controlled buildings.

“If you are a tenant, which is half of the city of Toronto, you will not see an increase,” she said.

The multi-residential tax rate increase, which applies to buildings with at least seven units, is 2.7 per cent.

Keeping the multi-residential rate at half of the regular residential rate prevents landlords from asking the provincial Landlord Tenant Board to permit rent hikes above the provincial guideline.

The budget also maintains the small business property tax discount, which is 15 per cent below the regular commercial property tax rate. Small businesses will pay 1.15 per cent in property taxes, compared to the regular commercial rate of 1.35 per cent.

Tax hikes aren’t the only new costs coming to Toronto taxpayers in 2025.

In December, council approved a 3.75 per cent increase to water and garbage rates, which together could add anywhere from $50 to $60 to the average annual bill.